Disclosure: This post may contain affiliate links. We may earn a commission if you sign up through our links, at no extra cost to you.

Most Canadians assume retirement is something you “figure out later.” Unfortunately, that’s why so many people end up working longer than they planned.

If you’ve ever wondered when can you retire in Canada, this guide gives you a simple, realistic self-check system, no hype, no pressure, just clarity.

More importantly, you’ll learn how to estimate your timeline and adjust it before it’s too late.

Why Most Canadians Underestimate Their Retirement Timeline

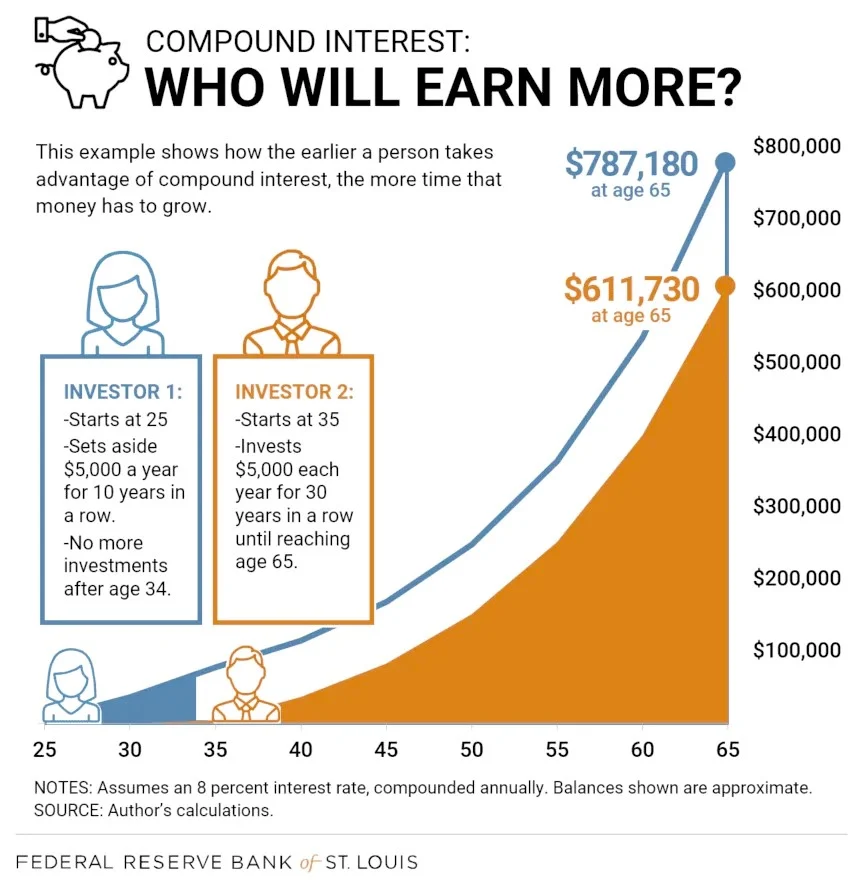

At first, retirement feels far away. Then suddenly, it isn’t.

Many people underestimate:

- How long investing takes to compound

- How much inflation reduces purchasing power

- How taxes affect withdrawals

- How expensive healthcare and housing can become

As a result, they save “a little” instead of “enough.”

That’s why answering when can you retire in Canada early gives you a massive advantage.

What Does “Retirement” Mean Today in Canada?

Retirement isn’t one-size-fits-all anymore. Instead, most Canadians choose flexible versions.

Full retirement

Stop working completely and live off savings and benefits.

Semi-retirement

Work part-time or consult while drawing income.

Coast FIRE

You stop contributing early and let investments grow.

Flexible work

Switch to lower-stress or passion-based work.

In practice, many Canadians combine these approaches.

The 4 Factors That Determine When You Can Retire in Canada

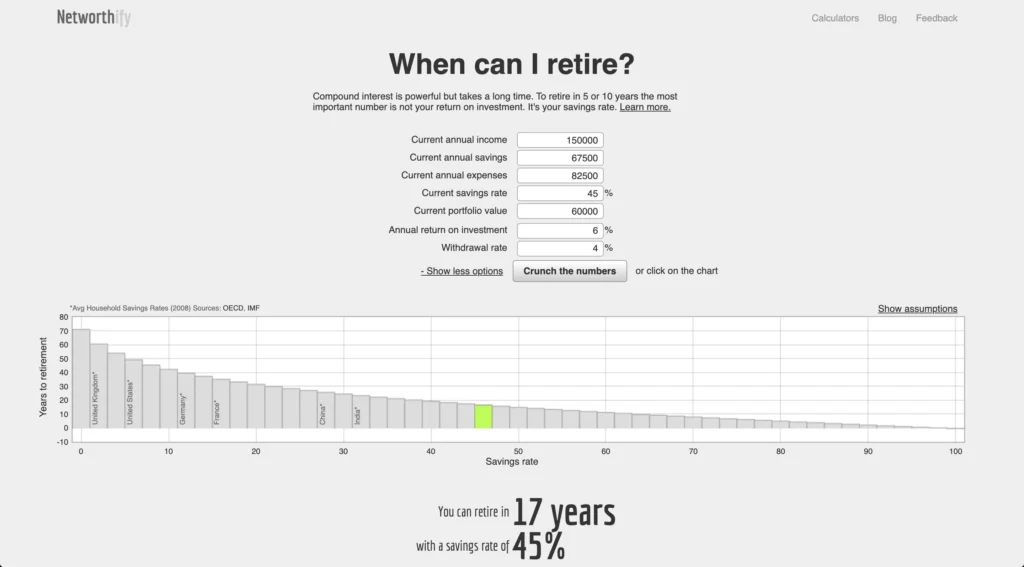

Your retirement age depends on four variables. Change one, and the timeline shifts.

Current savings

The more you’ve already invested, the faster you can finish.

Monthly investments

Consistent contributions matter more than income.

Lifestyle expenses

Higher spending requires a larger portfolio.

Expected return

Long-term ETF portfolios usually outperform savings accounts.

Together, these decide when can you retire in Canada more than any single number.

Step 1: Calculate Your Retirement Number (Canada Method)

Before estimating timing, you need a target.

Annual spending × 25

This is the classic starting point.

Example:

$48,000 × 25 = $1,200,000

4% rule overview

The 4% rule suggests withdrawing 4% annually.

However, many Canadians prefer 3%–3.5% for safety.

Canada-specific adjustments

Because of taxes and CPP/OAS, some retirees can target slightly lower totals.

FIRE Movement in Canada explains this in more detail.

For deeper math, see Investopedia’s 4% rule guide.

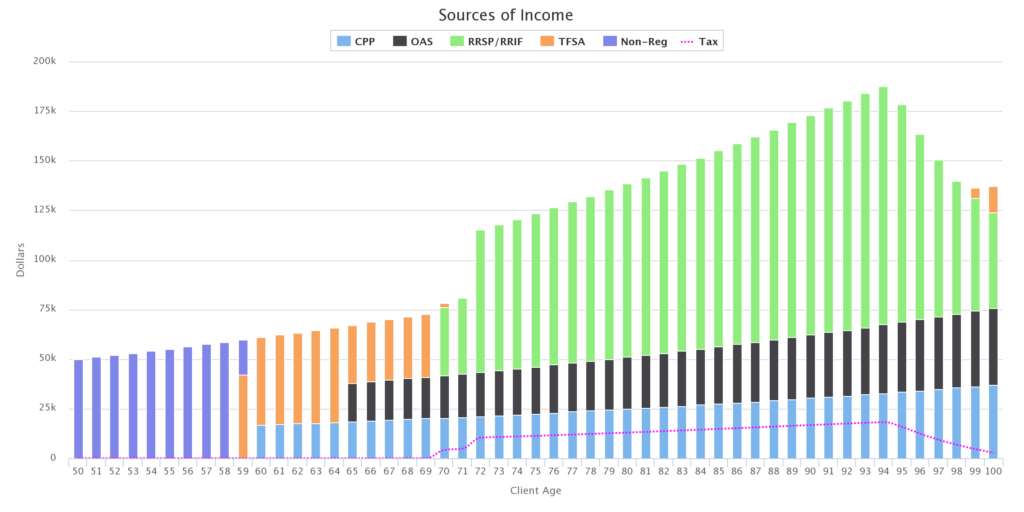

Step 2: Estimate Your Retirement Income Sources

Next, identify where your income will come from.

CPP (Canada Pension Plan)

Depends on your lifetime contributions.

OAS (Old Age Security)

Available to most seniors, with clawbacks at higher income.

According to Government of Canada CPP and OAS overview, these benefits supplement private savings.

RRSP/RRIF

Taxable income from registered accounts.

TFSA

Tax-free withdrawals, extremely valuable.

Personal investments

Non-registered accounts, rental income, or businesses.

Retirement Income Strategy (2026) shows how to combine these efficiently.

Step 3: Check Your Current Progress

Now, compare where you are to where you need to be.

Net worth snapshot

Calculate assets minus liabilities.

Savings rate

Track how much you invest each month.

Portfolio size

Focus on invested assets, not home value alone.

How to Track Your Net Worth gives you a simple tracking system.

At this stage, most people finally see when can you retire in Canada realistically.

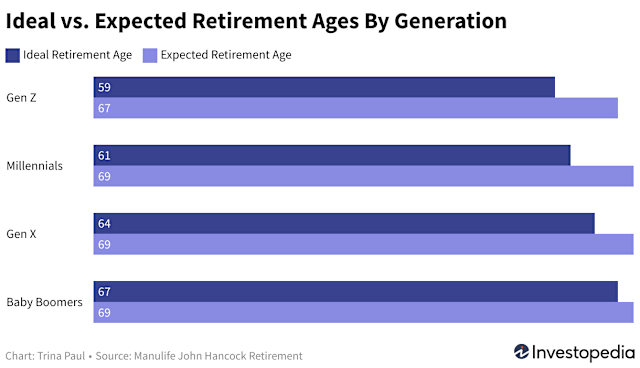

Retirement Age Scenarios (Canada Examples)

Let’s look at common timelines.

Age 25 starter

- Starts investing early

- $600/month

- Retirement: 55–60

Age 35 starter

- Moderate savings

- $800/month

- Retirement: 60–65

Age 45 starter

- Catch-up mode

- $1,200+/month

- Retirement: 65–70

Late starter

- Starts after 50

- High contributions

- Retirement: 70+

According to Vanguard, early consistency beats late intensity.

How TFSAs and RRSPs Affect Your Retirement Age

Your account strategy directly impacts timing.

Tax efficiency

Lower taxes = faster compounding.

Withdrawal planning

Better planning = higher usable income.

Account prioritization

Most Canadians benefit from:

- TFSA first

- RRSP second

- FHSA if applicable

TFSA vs RRSP vs FHSA explains how to prioritize properly.

For official limits, see CRA registered plans guide.

How to Retire Earlier in Canada (Without Burnout)

If your timeline feels too long, you have options.

Increase savings rate

Even +5% makes a big difference.

Invest in ETFs

Low-cost ETFs maximize long-term returns.

Best ETFs for Beginners (2026) shows safe options.

Reduce expenses

Focus on housing, cars, and subscriptions.

Delay lifestyle inflation

Don’t upgrade everything when income rises.

How Much Should You Invest Each Month helps you optimize contributions.

Small changes today can move retirement forward by years.

What Can Delay Retirement

Many people lose time because of avoidable mistakes.

High debt

Interest works against you.

Low investing consistency

Skipping months slows compounding.

Panic selling

Selling during crashes destroys progress.

Poor asset allocation

Too conservative early = slower growth.

Avoiding these keeps your timeline intact.

Early Retirement vs Traditional Retirement in Canada

Both paths can work. The right one depends on you.

Pros and cons

Early retirement:

- More freedom

- More uncertainty

Traditional retirement:

- More security

- Less flexibility

Risk tolerance

Early retirees must handle volatility.

Health considerations

Longer retirements require larger buffers.

Choose based on comfort, not trends.

Simple Retirement Timeline Template

Use this as a planning framework.

Where you are now

- Net worth

- Monthly investing

- Debt level

Next 5 years

- Increase savings

- Max TFSA/RRSP

- Stabilize income

Next 10 years

- Portfolio growth

- Reduce major debt

- Prepare income plan

Final phase

- Optimize taxes

- Test withdrawals

- Review annually

This keeps when can you retire in Canada visible and actionable.

Final Retirement Readiness Checklist

Before you commit to a date, confirm this.

Retirement number set

You know your target.

Accounts optimized

TFSA and RRSP used properly.

Portfolio diversified

Low-cost ETFs, global exposure.

Income plan ready

Withdrawal strategy in place.

Annual review habit

Adjust as life changes.

If you follow this system, answering when can you retire in Canada becomes simple, not stressful.

Frequently Asked Questions

What is the average retirement age in Canada?

Most Canadians retire between 62 and 65.

Can I retire at 55 in Canada?

Yes, with strong savings and disciplined investing.

Do I need a million dollars to retire?

Not always. It depends on expenses and benefits.

Should I rely on CPP and OAS?

No. They help, but they shouldn’t be your main plan.