Disclosure: This post may contain affiliate links. We may earn a commission if you sign up through our links, at no extra cost to you.

Introduction

Canadians love to invest, but choosing between a TFSA, RRSP, or the new FHSA can feel confusing. Each account offers unique tax advantages and benefits and choosing the right one can make a big difference in how fast your money grows.

Most Canadians don’t pick the wrong account because they’re stupid, they pick the wrong one because nobody ever explained the rules clearly. This guide fixes that in 5 minutes.

By the end of this guide, you’ll know exactly which account to prioritize in 2025 based on your income, goals, and lifestyle.

Related reads:

Understanding the Basics

Let’s start by breaking down what TFSA vs RRSP vs FHSA 2025 account are and how they work.

What Is a TFSA?

The Tax-Free Savings Account (TFSA) lets you invest without paying tax on growth or withdrawals.

It’s perfect for flexible investing and short-to-medium-term goals, like saving for a car, a home, or financial independence.

- 2025 contribution limit: $7,000

- Lifetime maximum: around $95,000 (depending on age)

- Best for: Investing in ETFs, dividend stocks, or GICs tax-free

Example: Buy ETFs like VFV or XIC, let them grow, and withdraw profits anytime without paying taxes.

What Is an RRSP?

The Registered Retirement Savings Plan (RRSP) helps you save on taxes today and grow your investments for the future.

Contributions reduce your taxable income, and your investments grow tax-deferred until you withdraw them in retirement, when your income (and tax rate) is likely lower.

Benefits:

- Great for high earners who want to lower taxes

- Can be used for the Home Buyers’ Plan (HBP) or Lifelong Learning Plan (LLP)

- Ideal for long-term retirement planning

Example: Contribute $5,000 and get a tax refund you can reinvest for faster compounding.

What Is an FHSA?

The First Home Savings Account (FHSA) is Canada’s newest registered account, perfect for first-time home buyers.

It combines the best of both worlds, RRSP-style tax deductions and TFSA-style tax-free withdrawals (for your first home).

Key details:

- $8,000 annual contribution limit

- $40,000 lifetime cap

- Tax-free withdrawals for qualifying home purchases

- Unused contributions can carry forward

Ideal for: Canadians planning to buy a home in the next 5–10 years.

Open an FHSA with Wealthsimple

TFSA vs RRSP vs FHSA — Key Differences

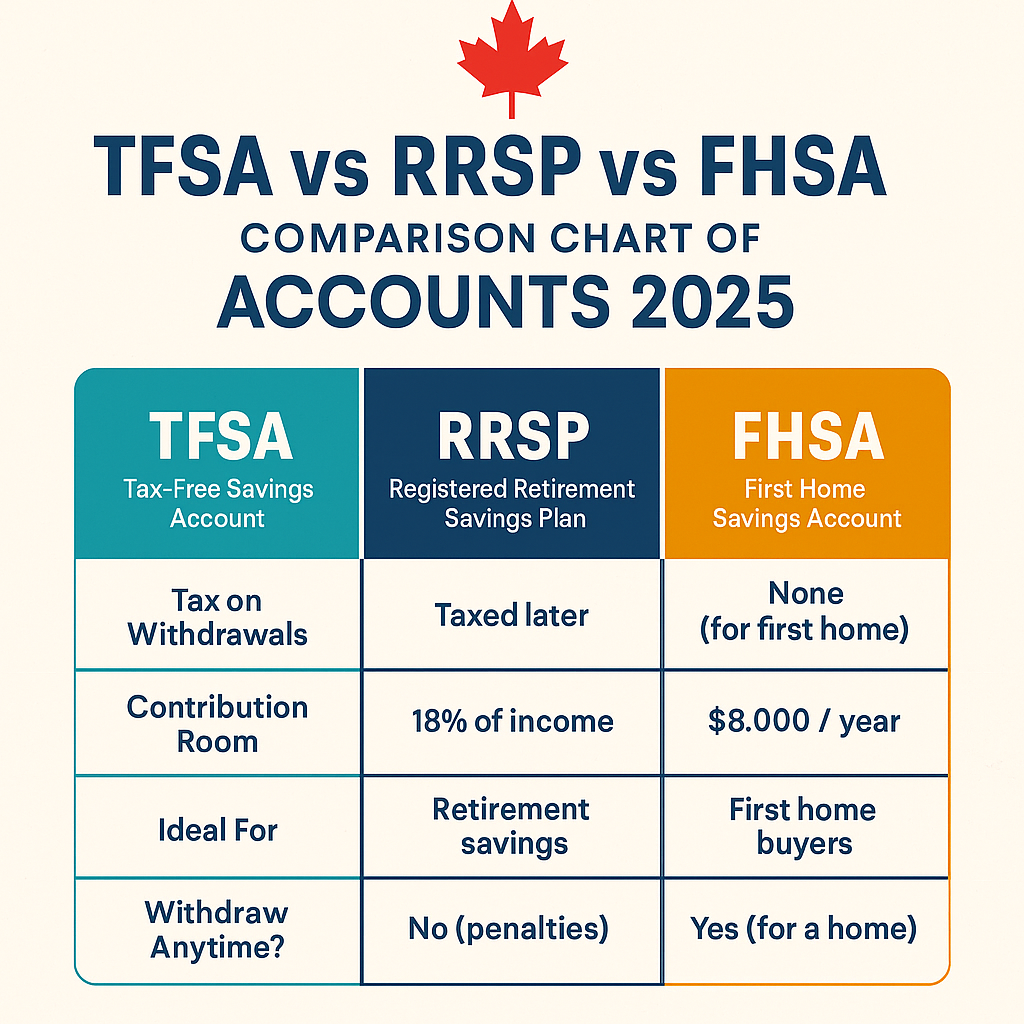

| Feature | TFSA | RRSP | FHSA |

|---|---|---|---|

| Tax on Withdrawals | None | Taxed later | None (for first home) |

| Contribution Room | Fixed yearly | Based on income | Fixed yearly |

| Ideal For | Flexible investing | Retirement savings | First home buyers |

| Withdraw Anytime? | Yes | No (penalties) | Yes, for a home |

| 2025 Contribution Limit | $7,000 | 18% of income | $8,000 |

Which Account Should You Choose in 2025?

If You’re Just Starting Out

Start with a TFSA, it’s flexible, simple, and tax-free. You can invest in ETFs, stocks, or GICs and withdraw anytime without penalties.

Learn more: How to Invest in Stocks in Canada with Little Money

If You’re Focused on Retirement

Choose the RRSP to maximize tax refunds and compound your returns faster. Every contribution reduces your taxable income, making it ideal for higher earners.

If You’re Saving for a Home

The FHSA should be your priority. You get a tax deduction on contributions and pay zero tax when withdrawing to buy your first home.

Pro tip: Combine FHSA + RRSP’s Home Buyers’ Plan to double your buying power.

Smart Strategy — Combine All Three

You don’t have to pick just one. Many Canadians use all three accounts strategically:

- RRSP – Reduce taxes on your income.

- TFSA – Invest for long-term growth or flexibility.

- FHSA – Save tax-free for your first home.

Example:

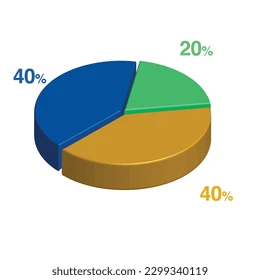

A 25-year-old earning $60,000 could invest $500/month split as:

- 40% TFSA ($200)

- 40% RRSP ($200)

- 20% FHSA ($100)

This approach balances tax savings, flexibility, and homeownership goals, while keeping everything automated.

Final Thoughts

Each account has its strengths:

- TFSA for flexibility

- RRSP for retirement

- FHSA for first homes

You don’t need to choose one over the other, combine them strategically for maximum growth and tax savings.

Explore next: