Disclosure: This post may contain affiliate links. We may earn a commission if you sign up through our links, at no extra cost to you.

For most Canadians, saving for retirement feels straightforward. You earn, you invest, and you build a portfolio.

However, turning that portfolio into reliable income is much harder.

That’s why having a clear retirement income strategy for Canadians matters just as much as saving itself.

In this guide, you’ll learn how to create a sustainable, tax-efficient retirement income plan that lasts, without panic, guesswork, or unnecessary stress.

Why Saving Is Easier Than Withdrawing

Saving follows simple rules: invest regularly and stay consistent.

Withdrawing, on the other hand, is different.

For example:

- Markets fluctuate

- Taxes change

- Expenses vary

- Health costs rise

As a result, many retirees overspend early or become too afraid to spend at all.

A strong retirement income strategy for Canadians helps you find the right balance.

Where Retirement Income Comes From in Canada

Most retirees rely on several income sources, not just one.

CPP (Canada Pension Plan)

CPP provides a base income depending on your work history and contributions.

OAS (Old Age Security)

OAS is available to most seniors, although higher incomes may trigger clawbacks.

According to Government of Canada CPP and OAS overview, these benefits are meant to supplement, not replace, personal savings.

RRSP/RRIF income

RRSPs convert to RRIFs and provide taxable retirement income.

TFSA withdrawals

TFSA income is tax-free and very flexible.

Personal investments

Non-registered portfolios, rental income, and businesses may also contribute.

Together, these form the foundation of your retirement cash flow.

How Much Income Do You Need in Retirement?

There’s no universal “right” number. Instead, focus on your lifestyle.

Lifestyle-based estimates

Ask yourself:

- Where will I live?

- Will I travel often?

- Do I support family?

- What are my healthcare needs?

Replacement ratios

Many planners suggest replacing 60%–75% of pre-retirement income. Still, this is only a guideline.

Inflation impact

Because prices rise over time, today’s $50,000 may feel like $70,000 in 20 years.

For long-term projections, Investopedia’s retirement income guide explains inflation-adjusted planning.

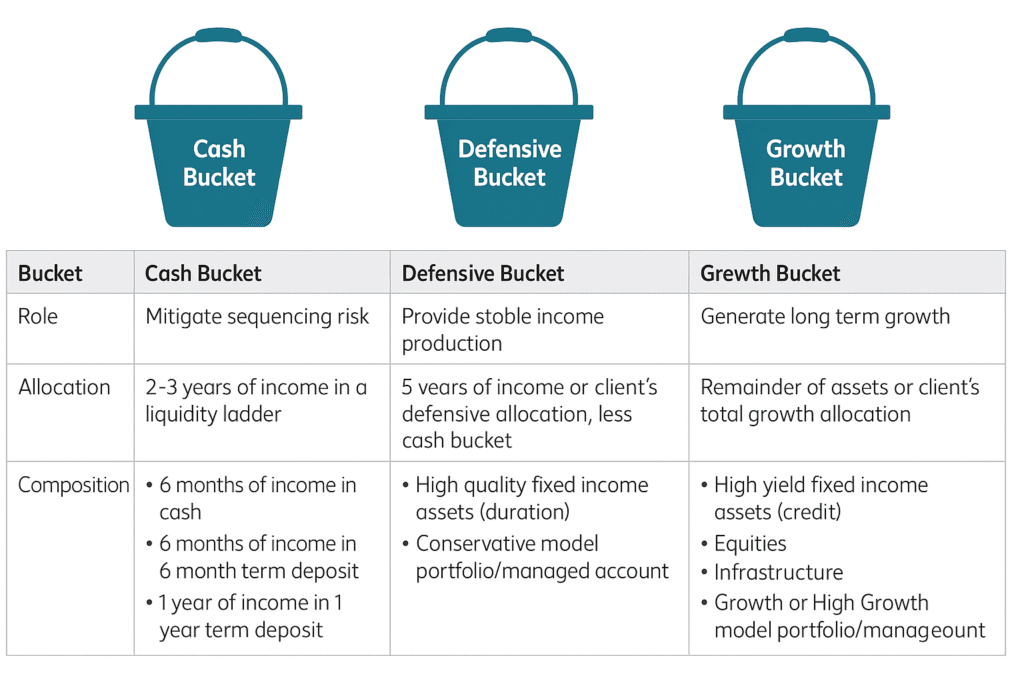

The 3-Bucket Retirement Income Strategy

One of the most practical retirement income systems is the three-bucket approach.

Short-term cash bucket (0–2 years)

- High-interest savings

- Money market funds

- Cash ETFs

This covers daily living expenses.

Medium-term income bucket (3–7 years)

- Conservative ETFs

- Balanced funds

- Bonds

This supports income when markets are volatile.

Long-term growth bucket (8+ years)

- Equity ETFs

- Growth funds

This protects against inflation.

As a result, you’re not forced to sell stocks during market crashes.

Best Accounts for Retirement Income in Canada

Account structure matters just as much as investments.

RRIF rules

By age 71, RRSPs must convert to RRIFs. After that, minimum withdrawals are mandatory and taxable.

TFSA withdrawals

TFSA withdrawals are tax-free and don’t affect government benefits.

Non-registered accounts

These provide flexibility but may trigger capital gains.

TFSA vs RRSP vs FHSA explains how each account fits into long-term planning.

For official rules, see CRA registered plans guide.

Dividend vs Total Return Approach for Retirement Income

Many retirees struggle with this choice.

Income investing (dividends)

Dividend portfolios generate cash without selling assets.

Pros:

- Predictable income

- Psychological comfort

Cons:

- Less diversification

- Potential tax inefficiency

Growth + withdrawals (total return)

This approach uses both growth and controlled selling.

Pros:

- Better diversification

- Often higher long-term returns

Cons:

- Requires discipline

Tax efficiency

Total return strategies often work better in registered accounts.

Best Dividend ETFs in Canada explains when dividend investing makes sense.

According to Vanguard withdrawal research, total return strategies are often more sustainable long term.

How to Withdraw From Investments Safely in Retirement

This is the core of any retirement income strategy for Canadians.

The 4% rule (Canada context)

The traditional rule suggests withdrawing 4% annually. In Canada, taxes and longevity may require closer to 3%–3.5% for safety.

Variable withdrawal method

Instead of fixed amounts, withdrawals adjust based on market performance.

Sequence of returns risk

Poor returns early in retirement can permanently damage portfolios.

Because of this, early caution is critical.

For deeper analysis, see Investopedia’s sequence risk guide.

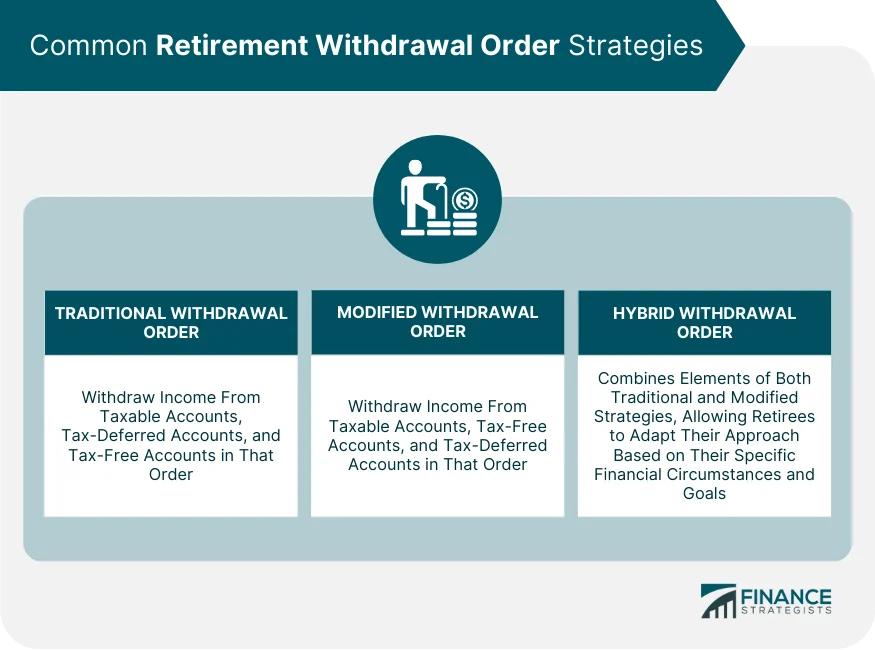

Tax-Efficient Withdrawal Order for Canadians

Withdrawing in the right order can save tens of thousands in taxes.

1. TFSA first

Tax-free withdrawals preserve government benefits.

2. RRSP/RRIF next

Gradual withdrawals reduce future tax spikes.

3. Non-registered last

This allows capital gains to keep compounding.

However, individual situations vary. Therefore, personalized planning is often helpful.

Retirement Income Example (Realistic Scenario)

Let’s put this into practice.

Profile

- Age: 65

- Portfolio: $900,000

- TFSA: $200,000

- RRIF: $600,000

- Non-registered: $100,000

Income plan

- CPP + OAS: $18,000/year

- Portfolio withdrawal: $27,000/year

- Total income: $45,000/year

Withdrawal structure

- TFSA: $6,000

- RRIF: $17,000

- Non-registered: $4,000

This balanced approach reduces taxes and preserves flexibility.

This is a practical example of a strong retirement income strategy for Canadians.

Common Retirement Income Mistakes

Many retirees struggle because of these errors.

Overspending early

Spending too much in the first decade increases long-term risk.

Ignoring taxes

Gross income and net income are not the same.

No rebalancing

Portfolios still need maintenance in retirement.

Panic selling

Selling during downturns locks in losses.

Avoiding these mistakes protects your lifestyle.

How Often to Review Your Retirement Income Plan

Retirement planning is not “set and forget.”

Annual checkups

Review income, taxes, and asset mix yearly.

Market adjustments

After major market swings, reassess withdrawals.

Health and life changes

Medical costs, family support, and housing changes matter.

Regular reviews keep your plan realistic.

Final Retirement Income Checklist for Canadians

Before retiring, confirm these steps:

Estimate your needs

Calculate realistic spending targets.

Set a withdrawal rate

Usually 3%–4% depending on risk.

Optimize taxes

Structure accounts and timing.

Review yearly

Adjust as life evolves.

If you follow this system, your retirement income strategy for Canadians becomes predictable, flexible, and sustainable.

Frequently Asked Questions

How much can I safely withdraw in retirement in Canada?

Most Canadians aim for 3%–4%, depending on risk and longevity.

Should I use TFSA in retirement?

Yes. TFSA withdrawals are extremely valuable for tax planning.

Do I need dividend stocks for income?

Not necessarily. Total return strategies often work better.

When should I convert my RRSP to RRIF?

By December 31 of the year you turn 71, at the latest.