Disclosure: This post may contain affiliate links. We may earn a commission if you sign up through our links, at no extra cost to you.

Most Canadians are still paying bank fees they don’t need, monthly fees, ATM surcharges, and minimum balance traps. No-fee banking is real in 2026, and this guide explains how it works and where to get it without surprises or hidden conditions.

If you’re tired of paying your bank just to hold your money, keep reading.

What Counts as “No-Fee Banking” in 2026?

A true no-fee account should offer:

- $0 monthly fees

- No minimum balance rules

- Free Interac e-Transfers

- Low-cost ATM access (or a free network)

- Online/mobile banking + bill pay

- No surprise “paper statement” fees

If a bank charges for basic actions, it’s not truly free.

Best No-Fee Banking Options in Canada (2026)

| Bank/App | Monthly Fees | Best For | Why It Works |

|---|---|---|---|

| EQ Bank | $0 | Everyday users | No-fee setup + powerful savings pairing |

| KOHO | $0–$9 | Debit + cashback | Rewards + budgeting tools |

| Tangerine | $0 | Beginners | Easiest to start with + promos |

| Simplii Financial | $0 | CIBC users | Big bank ecosystem without big bank fees |

| Neo Money | $0 | Rebuilding finances | Good starter/recovery option |

EQ Bank Best Overall No-Fee Option

EQ Bank continues to dominate no-fee banking because it’s simple, online, and avoids the classic big-bank traps. Plus, pairing it with a HISA unlocks real savings growth, unlike chequing accounts earning 0.01%.

It also works well alongside Best High-Interest Savings Accounts in Canada for storing an emergency fund.

KOHO Best Cashback Debit Option

KOHO isn’t a traditional chequing account. It’s a prepaid debit system with cashback, spending controls, and budgeting tools built in. For many Canadians, it starts as a “training bank” before upgrading to credit products.

Best for:

- Beginners

- Students

- People recovering from financial mistakes

Works extremely well with Beginner’s Guide to Canadian Credit Scores for rebuilding financial trust.

Tangerine Best Full Banking Experience

Tangerine is a great middle ground between fintech apps and big banks. You get digital banking convenience, but with promos, e-Transfers, and savings account pairings that actually make sense.

Pairs well with Best Chequing Accounts in Canada if you’re transitioning away from Scotiabank, RBC, or TD.

Simplii Financial Best Big Bank Alternative

Think CIBC… but cheaper. Simplii is essentially CIBC’s modernized online twin. It’s great if you want reliability and a familiar structure, without paying classic legacy fees.

Works well when paired with Budgeting Apps in Canada for young adults and families.

Neo Money Best for Rebuilding Finances

Neo Money helps people who are starting over: students, newcomers, or anyone who made credit mistakes and needs a clean, simple system again.

Internal synergy with Beginner’s Guide to Canadian Credit Scores and future upgrade applications.

Is Switching to No-Fee Banking Worth It?

Switch if:

- You pay fees every month

- You’re building an emergency fund

- You want automated transfers + e-Transfers

Don’t switch if:

- You depend on in-branch services weekly

- You prefer physical bank tellers for every task

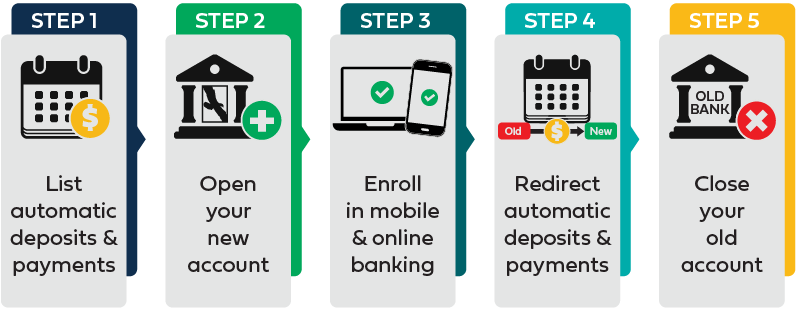

How to Switch Banks Without Messing Up

- Open the new account first

- Redirect payroll + government deposits

- Update auto-payments + subscriptions

- Close the old account last

This avoids declined bills and bounced payments.

Related: Best Chequing Accounts in Canada | Budgeting Apps in Canada

Final Recommendation (Simple Breakdown)

| If you want… | Choose |

|---|---|

| Everyday, simple banking | EQ Bank |

| Cashback + debit perks | KOHO |

| Big bank experience w/out fees | Tangerine |

| CIBC ecosystem feel | Simplii Financial |

| Rebuilding & starting over | Neo Money |

FAQ (Beginner-Friendly)

Does switching banks hurt my credit score?

No, switching chequing accounts does not affect your credit.

Do I need to close my old bank?

Not immediately. Run both for 30–60 days to avoid missed payments.

Are prepaid debit systems “real banking”?

They’re legitimate alternatives, but not full banking. Good first step.

Can I automate savings with no-fee banks?

Yes. especially EQ, Tangerine, and KOHO.

Don’t stay with a bank that charges you for existing.

Pick a no-fee option today, open the account, set up payroll, and automate your money. Freedom starts with one switch.