Disclosure: This post may contain affiliate links. We may earn a commission if you sign up through our links, at no extra cost to you.

If you’re new to investing in Canada, this is one of the first real decisions you’ll face: ETF vs robo-advisor.

And honestly, it’s where a lot of beginners get stuck. Both options are popular, both sound “safe,” and both are constantly recommended online.

So in this guide, I’ll give you a clear, no-BS answer based on your personality, your time, and your long-term goals, not hype or complexity.

Why Beginners Get Stuck Choosing

Most Canadians aren’t asking, “Which option is mathematically perfect?”

They’re really asking:

- How much effort do I want to put in?

- How likely am I to panic or procrastinate?

- Do I want simplicity or control?

The truth is, the best investing strategy is the one you’ll actually stick with.

What Is an ETF? (Quick Refresher)

What ETFs are

An ETF (Exchange-Traded Fund) is a basket of investments, usually stocks or bonds, that trades like a stock.

Instead of picking individual companies, you buy one ETF and instantly own hundreds or thousands of businesses.

How Canadians buy them

Canadians buy ETFs through online brokerages like Questrade, Wealthsimple Trade, or bank platforms.

You choose:

- The ETF

- The account (TFSA, RRSP, taxable)

- How much to invest

DIY investing basics

With ETFs, you’re in control. You decide what to buy, when to invest, and how to rebalance.

That freedom is powerful, but it comes with responsibility.

What Is a Robo-Advisor?

Automated portfolios

A robo-advisor builds and manages a diversified ETF portfolio for you.

You don’t pick ETFs. The platform does.

Risk questionnaires

You answer a few questions about risk tolerance and time horizon, and the robo assigns you a portfolio.

Rebalancing + automation

Robo-advisors automatically:

- Rebalance your portfolio

- Reinvest dividends

- Keep you on track

Platforms like Wealthsimple Managed Investing and Questwealth Portfolios are popular in Canada.

ETF vs Robo-Advisor (Quick Comparison Table)

| Feature | ETFs (DIY) | Robo-Advisor |

|---|---|---|

| Fees | Lower | Higher |

| Effort | More | Very low |

| Control | High | Low |

| Best for | DIY investors | Hands-off investors |

Pros & Cons of ETFs

Pros

Lower MERs

ETFs are cheap. Lower fees mean more of your money stays invested.

Full control

You decide asset allocation, timing, and strategy.

Tax efficiency

DIY ETFs allow better tax planning in TFSAs and RRSPs.

According to Vanguard Canada research , lower costs are one of the strongest predictors of long-term returns.

Cons

Requires discipline

You need to invest consistently and rebalance occasionally.

Emotional mistakes possible

Panic selling is the biggest enemy of DIY investors.

Manual rebalancing

Unless you use all-in-one ETFs, you’ll need to rebalance yourself.

Pros & Cons of Robo-Advisors

Pros

Fully automated

Set it up once and let it run.

Good for beginners

You don’t need to understand markets to start.

Reduces emotional investing

Automation prevents bad decisions during market swings.

Cons

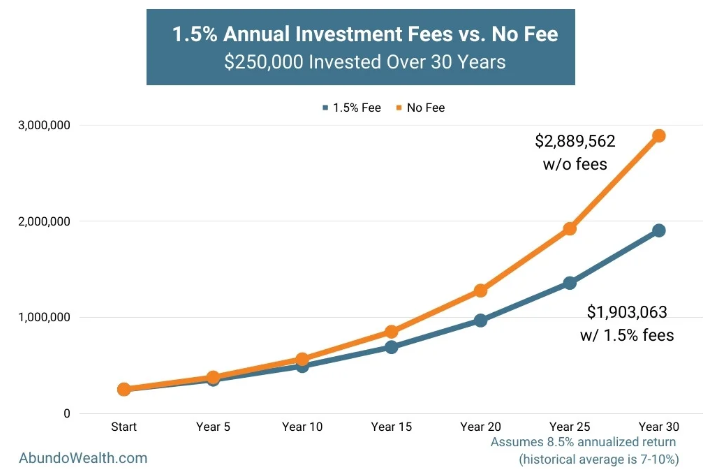

Higher total fees

Robo fees + ETF MERs add up over time.

Less customization

You can’t fine-tune your portfolio much.

Long-term cost drag

Even a 0.50% extra fee compounds heavily over decades.

Investopedia’s fee impact breakdown shows how small percentages can snowball long term.

Which Is Better for Beginners in Canada?

This comes down to personality, not intelligence.

Hands-on → ETFs

If you like learning, checking your portfolio, and staying involved, ETFs are usually better.

Hands-off → Robo-advisor

If you hate managing money or fear emotional mistakes, a robo-advisor is often the safer choice.

Time vs cost tradeoff

Robo-advisors save time. ETFs save money. Neither is wrong.

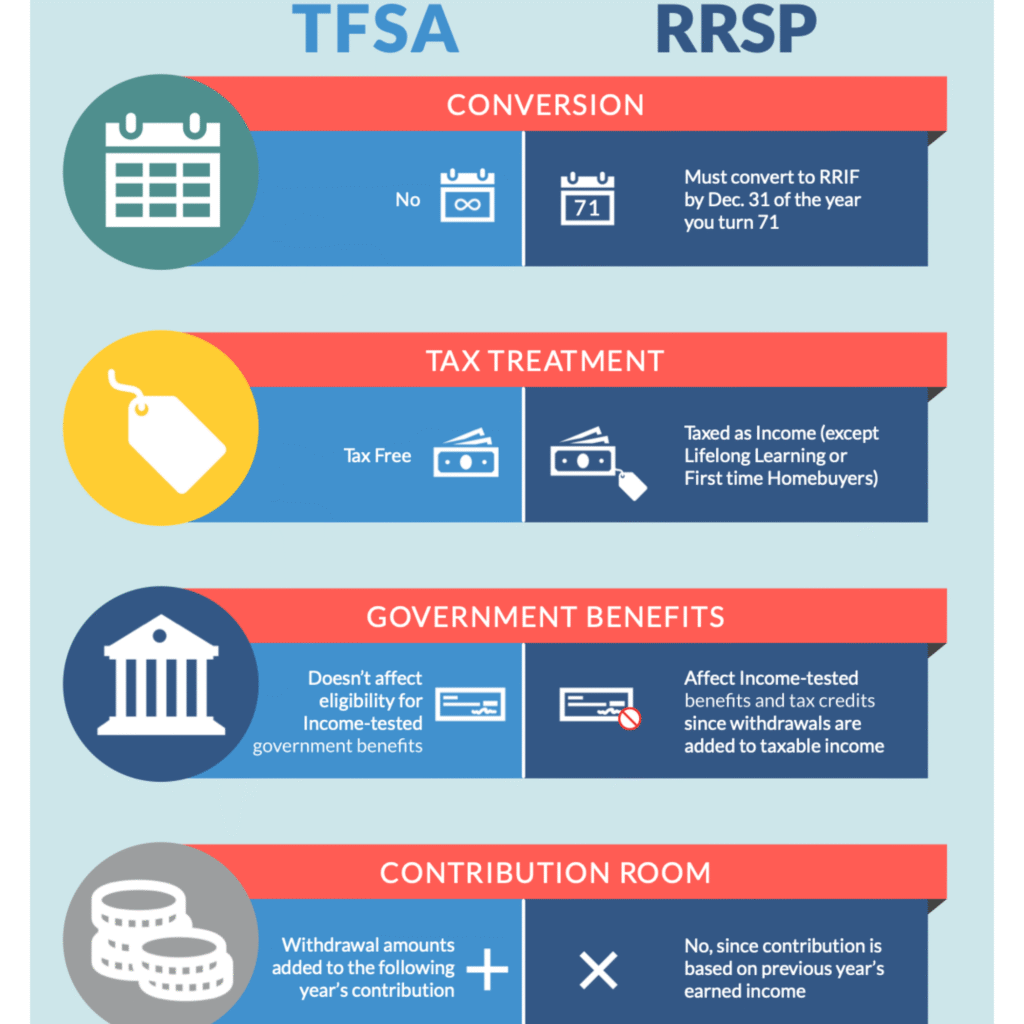

ETF vs Robo-Advisor in a TFSA

Tax impact (minimal difference)

Both are tax-sheltered in a TFSA, so taxes aren’t the deciding factor.

Ease of use

Robo-advisors win for simplicity.

Contribution automation

Robos make automatic contributions effortless, which helps consistency.

TFSA Investing Strategy for Beginners explains how to prioritize this account.

Best ETFs for Beginners in Canada (2026) helps if you want to go DIY.

For official TFSA rules, CRA TFSA overview is the authority.

ETF vs Robo-Advisor in an RRSP

Tax efficiency

Both work well inside RRSPs.

U.S. ETFs mention

Advanced investors can reduce U.S. withholding tax using U.S.-listed ETFs in RRSPs, something robo-advisors usually don’t optimize for.

When robo still makes sense

If you want zero effort and automatic investing, robo-advisors still do the job.

RRSP Investing Strategy for Beginners (2026) breaks this down clearly.

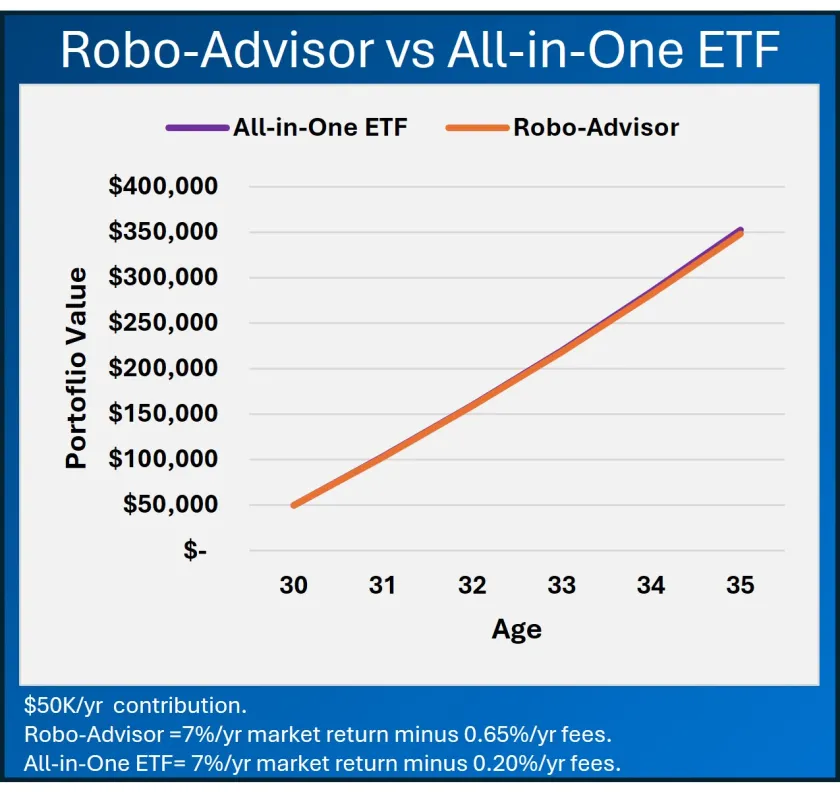

Cost Comparison Over Time (Simple Example)

Let’s keep this simple.

- $10,000 invested

- 20 years

- Same market returns

An extra 0.60% in fees from a robo-advisor can easily cost tens of thousands of dollars over time.

Fees compound just like returns, only in the wrong direction.

This is why long-term investors care so much about cost.

Can You Use Both?

Yes, and many Canadians do.

Hybrid approach

- Robo-advisor for hands-off automation

- ETFs for extra savings or learning

When it makes sense

If you’re transitioning from beginner to DIY, this can be a smooth middle step.

How to keep it simple

Avoid overcomplicating things. One robo account and one ETF account is more than enough.

Final Verdict

Best for total beginners

Robo-advisor

Start investing now, automate everything, avoid paralysis.

Best for cost-conscious investors

ETFs

Lower fees, more control, better long-term efficiency.

Best long-term choice

If you’re willing to learn and stay disciplined, ETFs usually win over decades.

The worst choice isn’t ETF or robo-advisor.

The worst choice is doing nothing.

Frequently Asked Questions

Is a robo-advisor safer than ETFs?

No, they use ETFs internally. The difference is automation, not risk.

Are ETFs too complicated for beginners?

Not if you use all-in-one ETFs.

Can I switch from a robo-advisor to ETFs later?

Yes, many investors do as confidence grows.

Do robo-advisors beat the market?

No. They aim to match market returns, minus fees.