Disclosure: This post may contain affiliate links. We may earn a commission if you sign up through our links, at no extra cost to you.

Reaching $100,000 in investments is the first major turning point in personal finance. Before that, progress feels slow. After that, compounding finally starts working with you.

In this guide, you’ll learn how to build a 6-figure portfolio in Canada using a realistic, repeatable system, not hype, shortcuts, or risky bets.

Most importantly, this roadmap works whether you earn $45,000 or $145,000.

Why $100,000 Is the First Major Milestone

Early investing feels frustrating because growth is small at first. However, once you cross six figures, momentum changes.

For example:

- At $10,000, a 7% return = $700

- At $100,000, a 7% return = $7,000

In other words, your money finally starts pulling its weight.

That’s why learning how to build a 6-figure portfolio in Canada is so powerful early in life.

What Does a 6-Figure Portfolio Really Mean?

$100k+ in investments

A true six-figure portfolio means $100,000+ invested in:

- TFSAs

- RRSPs

- Non-registered accounts

- Robo or ETF portfolios

It does not include your car, furniture, or random collectibles.

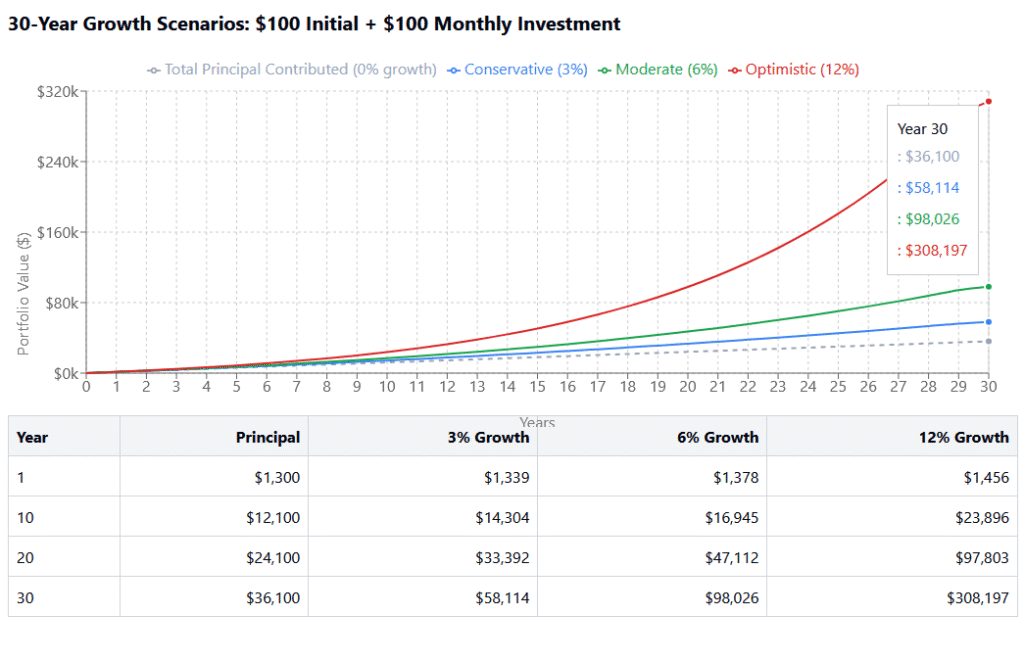

Why it changes compounding

Once you hit $100k, market growth often rivals your own contributions.

As a result, progress accelerates.

Psychological impact

After reaching six figures, many investors become more disciplined. Confidence improves. Panic decreases. Long-term thinking increases.

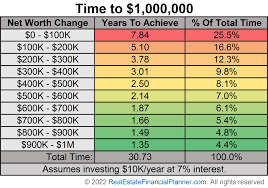

How Long Does It Take to Reach $100,000?

There’s no universal timeline. Still, patterns are clear.

Aggressive saver

- $1,000/month

- Moderate returns

- ~6–7 years

Average saver

- $400–$600/month

- Steady investing

- ~10–12 years

Late starter

- Starts in 40s

- Higher contributions

- ~8–10 years

Power of consistency

Most importantly, consistency matters more than income.

According to Vanguard long-term investing research, regular contributions outperform most timing strategies over time.

Step 1: Build the Right Financial Foundation

Before investing heavily, stabilize your base.

Emergency fund

Keep 3–6 months of expenses in cash.

Best High-Interest Savings Accounts helps you earn more on emergency savings.

Debt control

High-interest debt kills compounding. Therefore, prioritize credit cards and payday loans first.

Stable income

A predictable income makes automated investing possible.

Best Budgeting Apps in Canada helps you manage cash flow.

Without this foundation, building a six-figure portfolio becomes unnecessarily stressful.

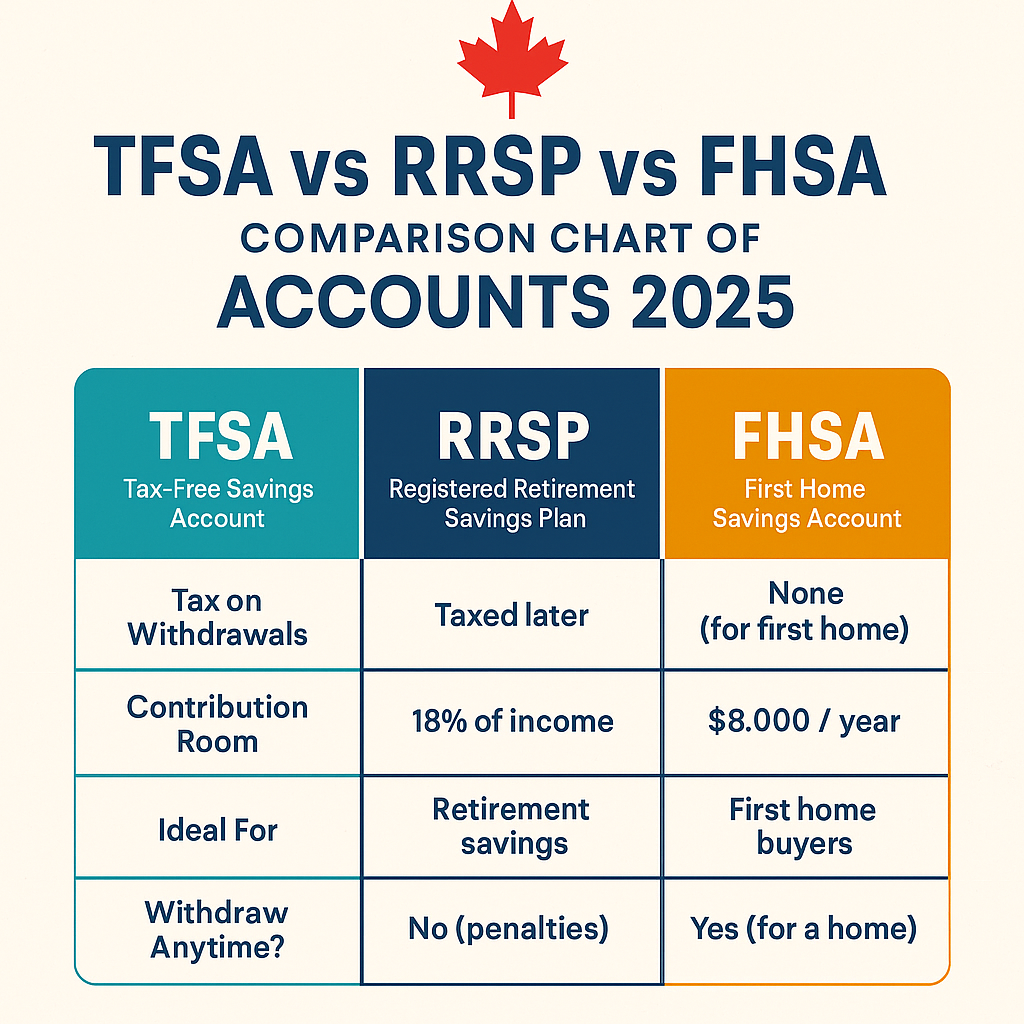

Step 2: Use the Right Accounts (TFSA First)

Account choice matters almost as much as investments.

TFSA priority

For most Canadians, the TFSA comes first:

- Tax-free growth

- Flexible withdrawals

- No impact on benefits

RRSP second

RRSPs shine in higher tax brackets and peak earning years.

FHSA (if applicable)

If buying a home, FHSA can accelerate progress.

TFSA vs RRSP vs FHSA explains how to prioritize properly.

For official limits, see CRA registered accounts overview.

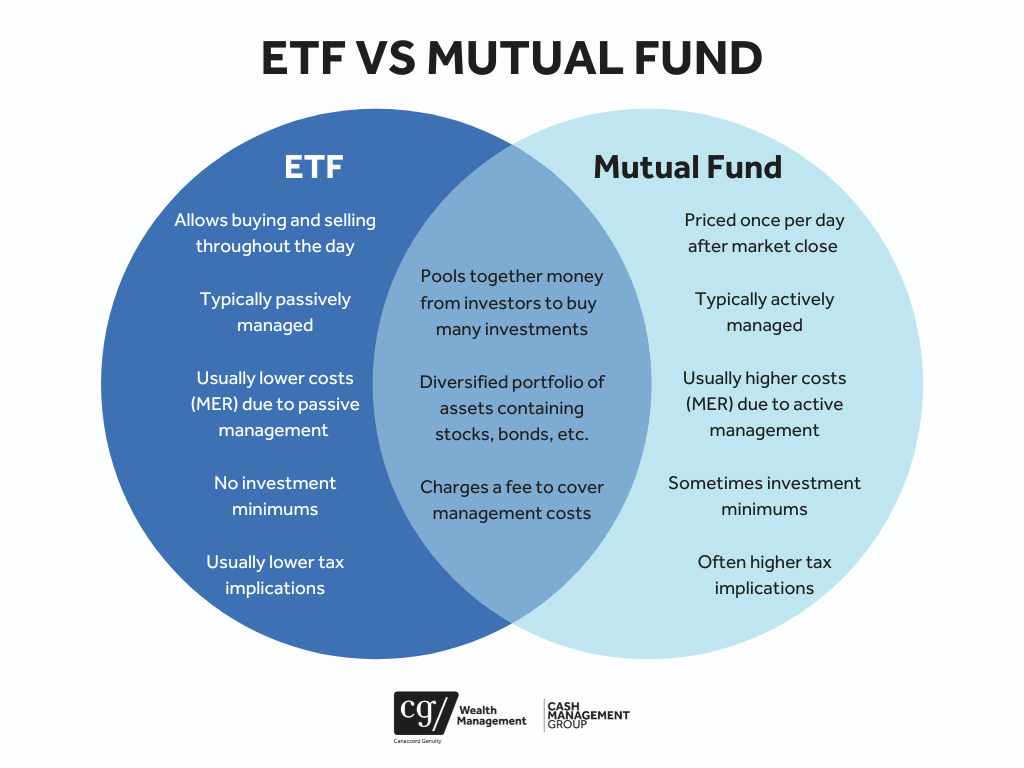

Step 3: Invest in Simple, Scalable Assets

Complexity slows progress. Simplicity scales.

Broad-market ETFs

These give you exposure to thousands of companies instantly.

All-in-one ETFs

One fund. Global diversification. Automatic rebalancing.

Avoid speculation

Crypto hype, meme stocks, and options trading delay wealth building.

Best ETFs for Beginners (2026) shows safe starters.

Best Canadian ETFs for Long-Term Growth explains growth options.

In practice, low-cost ETFs outperform most DIY strategies long term.

Step 4: Invest Consistently (The Real Secret)

Talent matters less than discipline here.

Dollar-cost averaging

Invest the same amount every month, regardless of headlines.

Dollar-Cost Averaging (2026) explains why this works.

Automation

Automate transfers and purchases. As a result, emotions disappear.

Monthly discipline

Treat investing like rent: non-negotiable.

How Much Should You Invest Each Month helps you set targets.

This step is the backbone of how to build a 6-figure portfolio in Canada.

Step 5: Reinvest and Stay the Course

Once you’re investing regularly, protection becomes critical.

Reinvest dividends

Always reinvest early. Cash payouts slow growth.

Avoid withdrawals

Pulling money early resets compounding.

Long-term mindset

Think in decades, not quarters.

According to Investopedia’s compounding guide, reinvestment dramatically increases lifetime returns.

Sample Path to $100,000 (Canada)

Let’s make this concrete.

$250/month example

- Contribution: $3,000/year

- Timeline: ~18 years

- Slow but steady

$500/month example

- Contribution: $6,000/year

- Timeline: ~10–12 years

- Most common path

$1,000/month example

- Contribution: $12,000/year

- Timeline: ~6–7 years

- Aggressive strategy

Time + growth scenarios

Returns + consistency determine speed. Income helps, but habits matter more.

Portfolio Examples for Reaching $100k

One-ETF portfolio

- All-in-one ETF

- Lowest effort

- Ideal for beginners

Growth portfolio

- Mostly equities

- Higher volatility

- Faster potential growth

Balanced portfolio

- Stocks + bonds

- Smoother ride

- Slower progress

Beginner Portfolio Examples (2026) shows how to build each.

Choose the one you’ll actually stick with.

Common Mistakes That Delay $100k

Many people sabotage themselves here.

Market timing

Waiting for “the perfect moment” wastes years.

Panic selling

Selling during crashes locks in losses.

Lifestyle inflation

Raises shouldn’t disappear into spending.

Overtrading

Too much activity increases fees and mistakes.

Avoiding these shortcuts your path to six figures.

What Changes After You Reach $100,000?

This is where things get interesting.

Faster compounding

Growth accelerates noticeably.

Risk management

Protecting capital becomes more important.

Long-term planning

You start thinking in milestones, not balances.

Next milestones

$250k → $500k → $1M becomes realistic.

Reaching $100k is the gateway to serious wealth.

6-Figure Portfolio + FIRE / Retirement

$100k is a foundation, not the finish line.

How $100k fits FIRE

It’s often 10–15% of a FIRE number.

Retirement trajectory

Early six figures dramatically reduce future pressure.

FIRE Movement in Canada explains financial independence.

Retirement Planning (30s & 40s) shows long-term integration.

From here, your options multiply.

Final $100k Roadmap

If you want clarity, follow this:

Open accounts

TFSA first. RRSP second.

Pick ETFs

Low-cost, diversified, boring.

Automate

Remove willpower.

Rebalance

Once per year is enough.

Stay patient

Time does the heavy lifting.

This system is exactly how to build a 6-figure portfolio in Canada without stress.

Frequently Asked Questions

Is $100,000 enough to be “wealthy”?

No, but it’s the most important early milestone.

Can I reach $100k on an average salary?

Yes. Many do through consistency.

Should I take more risk to get there faster?

Usually no. Steady wins.

Does home equity count?

For this goal, focus on investments first.