Affiliate Disclosure: This post may contain affiliate links. We may earn a commission if you sign up through our links, at no extra cost to you.

Introduction

Passive income in Canada is one of the biggest financial trends of 2025, but it’s often misunderstood. It’s not a “get rich quick” scheme, it’s about creating something once and earning from it repeatedly. In this guide, you’ll learn the best passive income ideas for Canadians in 2025, including investing options, digital assets, and automated money systems that anyone can start.

To build your first income stream faster, explore Best Side Hustles Canada 2025 or the How to Save $10,000 in 2025 guide.

Best Passive Income Ideas in Canada (2025)

1. Dividend Investing (Truly Passive Long-Term Income)

Dividend-paying ETFs remain one of the strongest passive income ideas for Canadians in 2025.

Funds like VDY, XEI, and ZDV automatically diversify your portfolio and send cash to you monthly or quarterly. Holding these inside your TFSA makes the income tax-free.

If you’re comparing options, check out my full breakdown in Best Dividend ETFs Canada 2025.

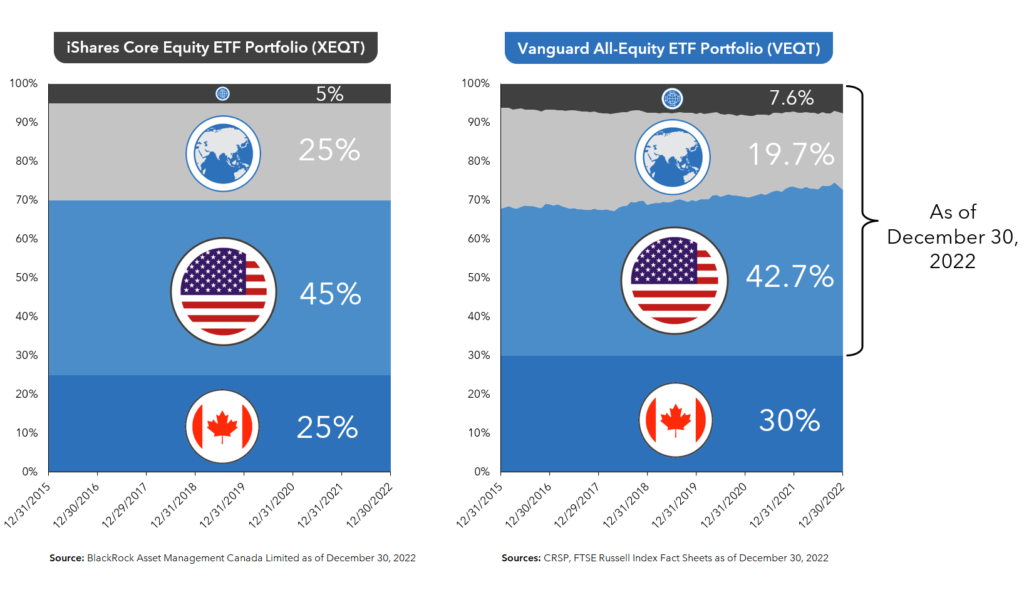

2. Index Funds & ETF Portfolios (Set-and-Forget Growth)

While index ETFs don’t always pay high dividends, they’re incredible for growing long-term wealth.

Top choices include: VEQT, XEQT, VGRO, XGRO.

As I always tell readers: “Consistency beats strategy. Automate one deposit and let compounding do the heavy lifting.”

See Best ETFs Canada 2025 for more guidance.

3. Robo-Advisors (Fully Automated Investing)

If you prefer a hands-off approach, robo-advisors invest for you automatically.

Top Canadian platforms:

They rebalance your portfolio without you lifting a finger. Learn more in Best Robo-Advisors Canada 2025.

4. High-Interest Savings Accounts (Simple, Safe Passive Income)

If you’re starting from zero, a HISA is the fastest passive income win.

EQ Bank, Tangerine, and Wealthsimple Cash offer 2–4% interest with zero effort.

Better yet, automate your transfers every payday.

More options here: Best High-Interest Savings Accounts Canada.

5. GIC Ladders (Guaranteed Returns)

If you want predictable, safe income, GICs pay consistent interest with no market risk.

A ladder (1-year, 2-year, 3-year) gives you liquidity while maximizing rates.

6. REITs (Real Estate Without a Mortgage)

REITs let you invest in commercial and residential real estate passively.

Popular picks include REI.UN, SRU.UN, and CAR.UN.

You get exposure to rental income without dealing with tenants.

7. Renting Out Extra Space

Surprisingly effective. You can rent out:

- Parking spot

- Basement room

- Storage space

- Garage or shed

This often brings $50–$400/month with almost no work.

8. Digital Products (High-Profit Passive Income)

Digital products are one of the most scalable passive income ideas Canadians can start in 2025.

Examples:

- Ebooks

- Templates

- Notion dashboards

- Printables

- Meal plans

Sell them on Etsy, Gumroad, or Shopify.

This also ties well with the ideas in Best Side Hustles Canada 2025.

9. Print-On-Demand (POD)

Upload designs → earn royalties forever.

Platforms like Printify, Redbubble, and Teespring handle printing and shipping.

Most creators earn $200–$2,000/month from consistent uploads.

10. YouTube (Faceless Channels Work in 2025)

You don’t need to show your face.

Faceless channels in finance, motivation, and AI are exploding.

Income streams:

- Ads

- Affiliates

- Digital products

- Brand deals

Once videos rank, they earn for years.

11. Affiliate Marketing

Recommend tools you already use → earn commissions.

Best niches for Canadians:

- Finance tools

- AI apps

- Tech products

- Amazon items

Start small, stay consistent, and let automation grow your monthly commissions.

12. Car-Based Passive Income

If you own a car, you can monetize it passively through:

- Turo rentals

- Advertising wraps

- Renting tools & equipment stored in the car

Minimal effort with recurring payouts.

13. Semi-Passive Local Services

Not fully passive, but they become recurring:

- Lawn care

- Snow removal

- Bin cleaning

- Home cleaning

Once you have repeat clients, income stabilizes without constant marketing.

How Much Passive Income Can You Earn in Canada?

Here’s what you can realistically expect:

- $100–$500/month → beginner

- $500–$2,000/month → consistent effort

- $2,000–$10,000+ → scaled digital products & investing

Most people overestimate what they can do in a week and underestimate what they can do in a year.

Passive Income Myths Canadians Should Ignore

❌ “It takes no effort”

❌ “You don’t need money to start”

❌ “Passive income happens fast”

❌ “You need a business degree”

Truth: you need either time, money, or both, but the payoff compounds massively.

The Smartest Way to Start (Beginner Roadmap)

- Build a small emergency fund

- Open a TFSA + HISA

- Automate your investing

- Add one digital income stream

- Reinvest profits back into your assets

- Track your progress monthly

Final Thoughts (With Call to Action)

You don’t need 10 income streams, just 1 or 2 that you stay consistent with.

The best time to start passive income was years ago. The second best time is today.

Pick one idea from this list, set it up this week, and automate your first $50.

Future you will thank you.

More helpful guides: