Affiliate Disclosure: This post may contain affiliate links. We may earn a commission if you sign up through our links, at no extra cost to you.

Introduction

Budgeting doesn’t have to feel restrictive, the right tool makes it automatic. In this guide to the best budgeting apps in Canada 2025, you’ll see how each app helps you track spending, stay organized, and actually save money.

Most budgeting apps in Canada look helpful, but half of them don’t actually change your habits. We tested the ones Canadians actually use and ranked them by features, fees, and results.

If you’re already improving your financial foundation, pairing an app with a strong savings account can multiply your results.

Related posts:

Why Use a Budgeting App in 2025?

Budgeting apps today are better than ever, they sync your bank accounts, categorize spending, and make money management effortless. Most Canadians overspend because they don’t actually see where the money goes. A good app fixes that in 24 hours.

A budgeting app in 2025 helps you:

- Track spending automatically

- Sync your debit + credit cards

- Identify overspending habits

- Build consistency (the real “secret weapon”)

- Prepare for investing later

Personal insight: One of the fastest ways I’ve seen people save an extra $200–$400/month is simply reviewing their “Subscriptions” category. Most don’t even realize what’s piling up.

Best Budgeting Apps in Canada (2025)

🥇 Mint (Canada) — Best Free Budgeting App

Mint is the classic, beginner-friendly option that lets you start budgeting in minutes. It’s fully free, automatically tracks categories, and gives a clean, simple view of your finances.

For Canadians who want a no-cost, no-stress tool, it’s the easiest place to start.

Mint also integrates well with Canadian banks and remains popular for users who want both mobile and desktop flexibility.

🥈 YNAB (You Need A Budget) — Best for Serious Budgeters

YNAB is for people who want total control over every dollar. It uses zero-based budgeting, a proven method that helps break the paycheck-to-paycheck cycle.

It’s not free, but the structure and accountability are worth it if you want to build long-term financial discipline.

I’ve seen many people eliminate thousands in credit card debt simply because YNAB forces intentional spending.

Learn more directly on the YNAB site: https://www.youneedabudget.com/

🥉 Wealthsimple Cash — Best for Young Adults

Wealthsimple Cash isn’t a traditional budgeting app, but it offers real-time spending insights, powerful categorization, and built-in automated savings.

Perfect for Canadians under 35 who want a simple, modern interface. Plus, Wealthsimple integrates with their investing platform, making it easy to send leftover money to ETFs or savings.

You can explore its features here: https://www.wealthsimple.com/en-ca/product/cash

Related post: Best High-Interest Savings Accounts Canada

KOHO — Best for Saving + Spending Control

KOHO acts like a prepaid Visa combined with budgeting tools and cashback rewards. With real-time spending notifications and saving “round-ups,” it’s especially good for building financial habits.

It’s one of the most practical tools for Canadians who want to rebuild credit or avoid overspending.

More details: https://www.koho.ca/

PocketGuard — Best for Overspenders

PocketGuard shows your “money left to spend,” which makes budgeting incredibly clear. It syncs multiple accounts and is ideal for people who have trouble managing impulse purchases.

Goodbudget — Best Envelope Budgeting App

Goodbudget uses the classic envelope method, simple and effective. It’s great for couples who want to coordinate joint spending or Canadians who prefer hands-on budgeting.

Comparison Table (2025)

| App | Best For | Price | Auto Sync | Unique Feature |

|---|---|---|---|---|

| Mint | Beginners | Free | Yes | Automatic categories |

| YNAB | Serious budgeters | $14.99/mo | Yes | Zero-based budgeting |

| Wealthsimple Cash | Young adults | Free | Yes | Real-time spending |

| KOHO | Saving while spending | Free–$9/mo | Yes | Cashback + budgeting |

| PocketGuard | Overspenders | $0–$12.99/mo | Yes | “Spendable money” |

| Goodbudget | Manual budgeters | $0–$7/mo | Partial | Envelope system |

How to Choose the Best Budgeting App

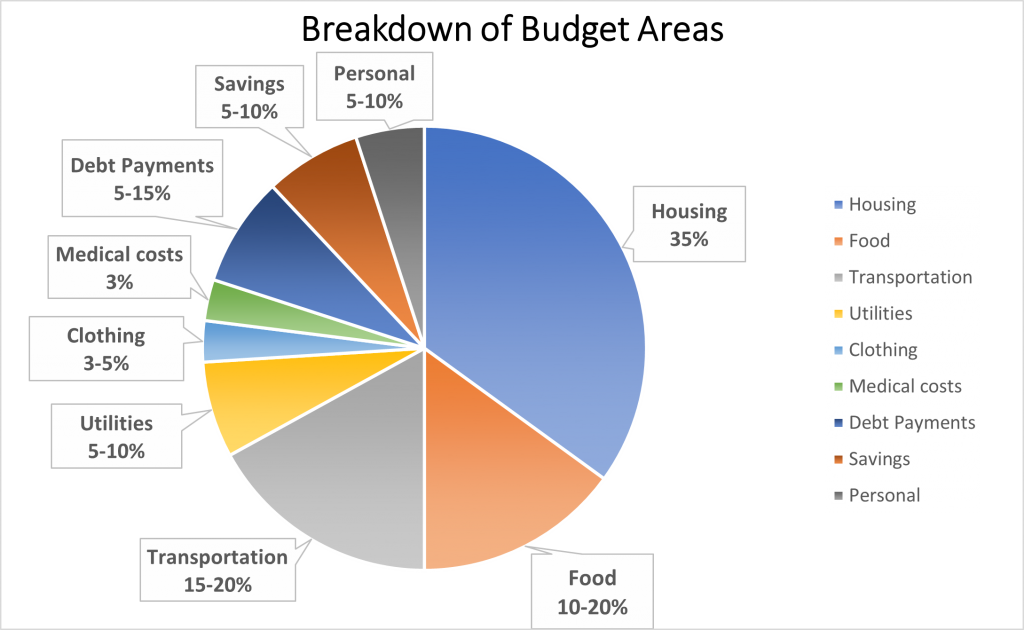

The best budgeting app depends on your lifestyle:

- Want free? → Mint or Wealthsimple Cash

- Want strict, habit-building structure? → YNAB

- Want cashback + budgeting? → KOHO

- Want the simplest option? → Wealthsimple Cash

Quick tip: Don’t overthink it, the “best app” is the one you’ll actually stick with.

How to Automate Your Budget (Step-by-Step)

- Sync your debit + credit cards

- Set monthly spending limits

- Turn on notifications

- Automate savings into a high-interest account

- Do a 5-minute review at the end of each month

For savings automation inspiration, here’s a great comparison of Canadian savings rates: https://www.ratehub.ca/savings-accounts

Common Budgeting Mistakes to Avoid

Most people sabotage their finances with simple mistakes:

- Tracking manually (you won’t stick with it)

- Not reviewing monthly spending

- Forgetting about subscriptions

- Failing to pair budgeting with investing

If you’re learning to invest with small amounts, this is a great beginner-friendly guide: https://www.wealthsimple.com/en-ca/learn/how-to-invest-money

Related post: How to Invest in Stocks with Little Money

FAQ: Best Budgeting Apps in Canada (2025)

1. What is the best free budgeting app in Canada?

Mint is the best fully free option, while Wealthsimple Cash is great for simple tracking and mobile-first spending insights.

2. Are budgeting apps safe for Canadians?

Yes, leading apps use bank-level encryption and secure API connections. Apps like KOHO, Mint, and YNAB are trusted across North America.

3. Do budgeting apps work with all Canadian banks?

Most major apps sync with RBC, TD, Scotiabank, CIBC, BMO, and credit unions.

4. Is YNAB worth paying for?

If you’re serious about budgeting and building discipline, yes. It’s the best option for eliminating overspending.

Final Thoughts

Budgeting apps are powerful tools, but the real power is consistency. The best budgeting apps in Canada 2025 make it easier to save money, control spending, and automate your financial growth.

Pick one today, set up automatic savings, and give yourself a cleaner financial foundation for investing and long-term wealth.

Related posts: