Disclosure: This post may contain affiliate links. We may earn a commission if you sign up through our links, at no extra cost to you.

When you’re new to investing, theory only goes so far. What most people actually need are clear beginner investment portfolio examples in Canada that feel realistic, simple, and doable.

That’s exactly what this guide delivers. No overengineering, no 12-ETF nonsense, just portfolios you can actually stick with.

Why Beginners Need Portfolio Examples, Not Theory

Most beginners already know they “should invest.”

What they don’t know is what a real beginner portfolio actually looks like.

Without examples, people either:

- Overcomplicate things

- Freeze and do nothing

- Or copy random portfolios they don’t understand

Seeing beginner investment portfolio examples for Canadians removes guesswork and builds confidence.

What Makes a Good Beginner Investment Portfolio in Canada?

A strong beginner portfolio isn’t fancy. It’s practical.

Diversification

You want exposure to many companies, sectors, and countries.

Low fees

High fees quietly destroy long-term returns.

Simplicity

The fewer moving parts, the easier it is to stay consistent.

Easy to maintain

You shouldn’t need to monitor your portfolio every week.

Fits TFSA or RRSP

Beginner portfolios should work cleanly inside registered accounts.

Before You Build a Beginner Investment Portfolio (Quick Checklist)

Before investing a dollar, make sure these basics are covered:

- Emergency fund started

- High-interest debt under control

- Investment account chosen (TFSA or RRSP)

TFSA vs RRSP vs FHSA helps you pick the right account before investing.

For official contribution rules, CRA registered accounts overview is the authoritative source.

Portfolio #1: One-ETF Beginner Investment Portfolio (Canada)

This is the simplest beginner investment portfolio example in Canada.

How it works

You buy one all-in-one ETF that holds thousands of stocks globally.

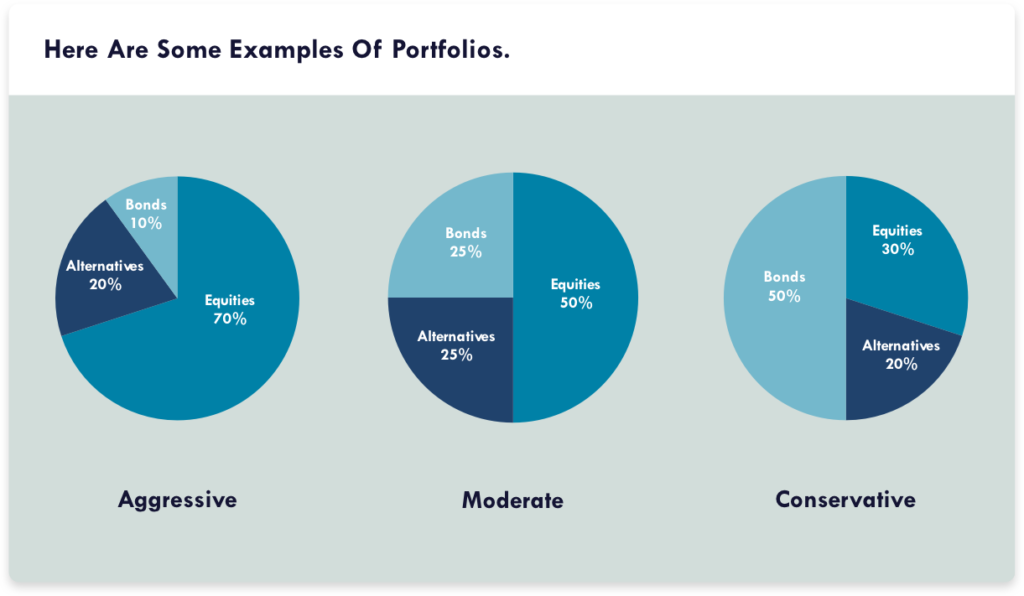

Risk levels explained

- Conservative, more bonds, lower volatility

- Balanced, mix of stocks and bonds

- Growth, mostly stocks, higher long-term returns

Who this is best for

- Total beginners

- People who want zero complexity

- Investors who value consistency over optimization

Best ETFs for Beginners in Canada (2026) breaks down the best all-in-one options.

Portfolio #2: Two-ETF Beginner Portfolio Example (Canada)

This option adds a small step up in control while staying simple.

How it works

- One Canadian equity ETF

- One global equity ETF

Why this works

- Slightly more flexibility

- Better control over home vs global exposure

- Still very easy to manage

Who this fits

- Beginners who want to learn

- Investors comfortable rebalancing once a year

According to Vanguard portfolio construction research, diversification across regions is a key driver of long-term stability.

Portfolio #3: Growth-Focused Beginner Investment Portfolio

This is a growth-first beginner investment portfolio example for Canada.

Equity-heavy allocation

Most or all of the portfolio is invested in stocks.

Long-term mindset

This portfolio assumes you won’t touch the money for 10–30 years.

Higher volatility explained

Big swings are normal. The goal is long-term growth, not short-term comfort.

Best Canadian ETFs for Long-Term Growth (2026) shows which ETFs suit this style.

Portfolio #4: Robo-Advisor Beginner Portfolio (Canada)

Some beginners want zero involvement. That’s where robo-advisors shine.

Fully automated option

You answer questions, and the platform builds and manages your portfolio.

Risk questionnaire

Your answers determine how aggressive or conservative your portfolio is.

When this makes sense

- You want hands-off investing

- You’re worried about emotional decisions

- You value automation over lowest fees

Platforms like Wealthsimple Managed Investing and Questwealth Portfolios are common Canadian options.

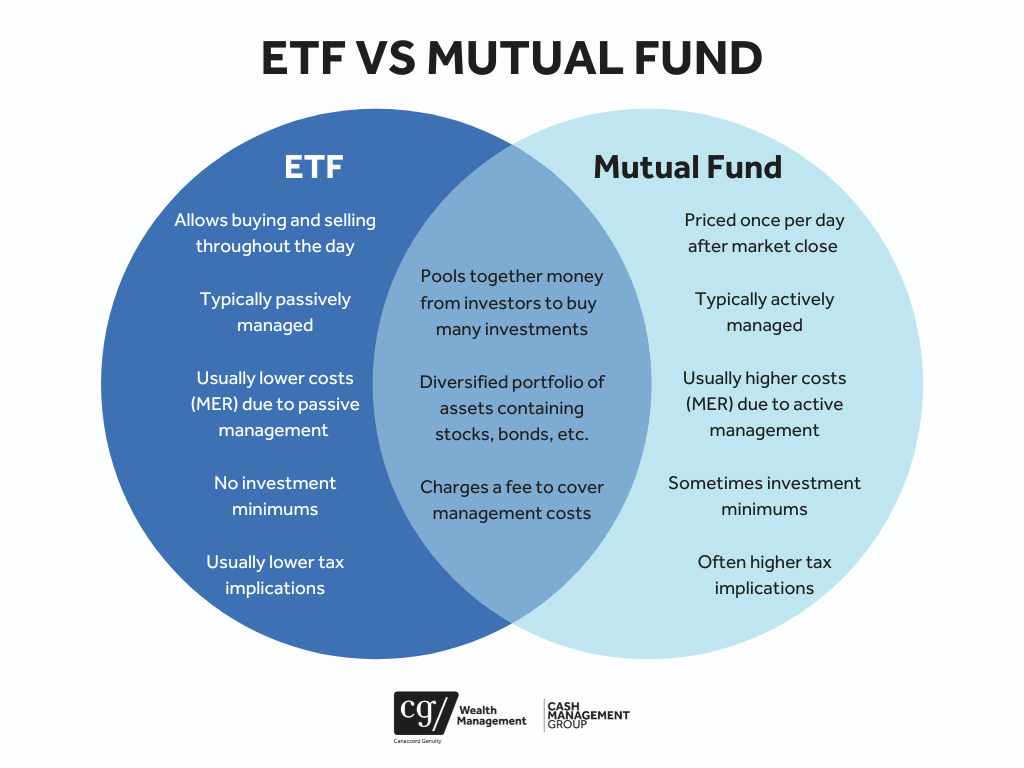

ETF vs Robo-Advisor: Which Is Better in Canada? helps you decide.

Portfolio #5: Hybrid Beginner Investment Portfolio

Yes, you can mix strategies.

Robo + DIY ETF approach

- Robo-advisor for automated investing

- DIY ETF portfolio for extra savings or learning

When to use this

- You’re transitioning from beginner to DIY

- You want automation plus flexibility

How to keep it simple

Limit yourself to one robo account and one ETF account, nothing more.

How Much to Contribute to a Beginner Investment Portfolio

Consistency matters more than amount.

Monthly investing examples

- $100/month → solid habit builder

- $300/month → strong long-term impact

- $500+/month → aggressive wealth building

Scaling contributions over time

Increase contributions as income grows instead of constantly changing strategies.

How Much Should You Invest Each Month in Canada? explains this clearly.

For compounding visuals, Investopedia’s compound growth guide is a helpful reference.

How to Maintain a Beginner Investment Portfolio

Rebalancing basics

- Once per year is usually enough

- All-in-one ETFs rebalance automatically

When to change (rarely)

Only adjust if:

- Your goals change

- Your time horizon shifts

- Your risk tolerance truly changes

What NOT to do

- Tinker constantly

- React to headlines

- Chase last year’s winners

Common Beginner Portfolio Mistakes in Canada

Even good portfolios fail when misused.

Too many ETFs

More ETFs doesn’t mean more diversification.

Chasing performance

Past returns don’t predict future results.

Frequent changes

Switching strategies resets compounding.

Panic selling

Selling during downturns locks in losses.

Final Recommendation for Beginner Investment Portfolios

Start simple

One ETF or one robo-advisor is enough.

Stick to one strategy

Consistency beats cleverness every time.

Increase complexity later

Only after experience and portfolio size grow.

The best beginner investment portfolio in Canada is the one you actually stick with.

Frequently Asked Questions

How many ETFs should a beginner own in Canada?

Usually one or two is plenty.

Is a robo-advisor good for beginners?

Yes, especially if you want automation and simplicity.

Should beginners invest in growth portfolios?

Often yes, if the time horizon is long.

Can I change portfolios later?

Yes, but avoid frequent changes.